Arnd has already given you some tips to make your real estate purchase successful and safe so that pleasure doesn't turn into frustration. From some technical considerations to some formal hurdles that can have an unpleasant end. Today I wanted to go into a little more detail on this topic and offer you a guide to the perfect purchase.

Before you jump into the buying process, make sure you don't get carried away with anticipation and take time to define your real estate needs carefully. This will ensure that you find the perfect home that meets all of your needs and feels like the perfect choice for you.

What type of property suits you?

Define what your lifestyle requirements are for a property. Do you want to live near a beach or oceanfront? Do you prefer an urban lifestyle or is outdoor space a must? Is all of this less important and having schools and some basic needs within 10 minutes would be enough? Or are you more interested in a rural place to live? Are you more of a country person or a city person? Do you like a rustic or modern style?

Villas with spacious gardens and private pools are among the most sought-after types of real estate in Mallorca. Row houses in the numerous "Urbanizaciones" with less land area, but a pool and a garage, are also very popular.

Mallorca also offers a wide range of apartments in different designs - directly on the coast or in the city. However, you should note that many of the buildings with partly the best coastal locations from the 70s. At that time, really great coastal strips were provided with these huge apartment blocks. Meanwhile, however, you can also find in these older buildings great renovated apartments, some of which even already with great views. Of course, the price is always determined by the location and size.

For many, a finca in Mallorca is also the dream of living in rural style under the southern sun. The island offers a wide range of finca and country houses for every need. Country houses are ideal for those seeking privacy, tranquility away from tourism and proximity to nature.

Do not hesitate too long and be realistic, because prices tend to rise for decades

If you're reading this post, you're probably already ten years too late to snag some of the best locations and best prices. The market continues to exhaust itself. You have to understand what you are getting for your money and be up to date so that when a great property comes along, you recognize it and don't hesitate. So inspect and compare a lot and strike when the right property appeals to you!

Find your perfect living paradise

It can be difficult to decide on a particular area of Mallorca if you have little knowledge of the island. I strongly recommend that you first rent an accommodation while you are looking for the right property to buy, in order to get a better feel for the area and to find out which area suits you best.

It is recommended to consider Palma. From El Molinar / Portixol to Old Town or Son Vida and surrounding areas. The city offers a variety of properties to choose from with either sea views, historic charm or modern features in a lively environment.

To enjoy a more relaxed atmosphere on the island, you should explore the southwest, from Bendinat to Andratx. These areas have been highly rated for years and offer a wide range of options. You'll find modern resorts as well as quiet mountain villages and luxurious villas - most with breathtaking views of the Tramontana Mountains or the clear bays. Although it can be a bit more expensive, the region is a worthwhile investment, offering top-notch infrastructure and an international community.

The north of Mallorca is also very popular with real estate buyers, especially the British and Germans. The region impresses with its natural beauty all year round. However, some places may be like extinct during the winter months. In this part of the island, Pollensa and Port de Pollensa shine.

For more information just read our top 7 layers!

Where and how to start your search?

Starting your real estate search can be an exciting, yet overwhelming experience. With so many search options out there, it can be difficult to know where to start. From real estate portals, to numerous brokers, you will be virtually inundated with the plethora of possible search options.

One of the best ways to get started is to search online. There are many real estate platforms that list properties from various real estate agencies and private owners. Be sure to explore as many sources as possible to get a feel for how the market is currently set up. To increase your chances of success, keep checking for new listings in different sources.

After the online research, it makes sense to deal with the appropriate brokers. The brokers on Mallorca often have a large portfolio, but they are usually specialized in a specific area. If you have a specific area in mind, research which brokers are the market leaders in that area.

However, despite all rational aspects, a real estate purchase is often decided by emotions

Often we first think about the practical aspects: Location, size, price, amenities and so on. We try to be logical and rational in our decision-making process, weighing the pros and cons of each option. But what about the emotional aspect of buying a home? What about that feeling you get when you walk into a place and it just feels right?

As an ex-realtor, I have observed this phenomenon over and over again. Clients will tour different properties and try to be objective and analytical, but when they walk into that one special place, they just know. It's not just about the number of bedrooms or the square footage, it's about the feeling.

Some people may dismiss this as irrational or unimportant, but I believe it is crucial. After all, a home is not just a physical space, but a place where we live our lives, create memories, and have a sense of belonging. If we don't feel a connection to the place, it's unlikely we'll be happy there in the long run.

Of course, there are practical considerations that cannot be ignored. Budget, location and other factors all play a role in the decision-making process. But I always encourage intuition. So if you walk into a place and immediately feel at home, that's a strong signal!

Now we come to the legally important things when buying real estate in Mallorca

When buying real estate in Mallorca, there are specific legal requirements that need to be considered. Here are some of the legal requirements you should know before buying a property in Mallorca.

- NIE number: The first and most important legal requirement for buying property in Mallorca is to apply for a Spanish tax number known as NIE (Número de Identificación de Extranjeros). Without this number you will not be able to buy a property, take out a mortgage loan or even buy a car on the island. The NIE can be applied for either by visiting the Oficina de Extranjería in Palma de Mallorca or by hiring a gestoria from this official agency. To apply for the NIE you will need your passports and two passport photos.

- Bank Account: Once you have received your NIE numbers, the next step is to open a bank account in Mallorca. You will need a Spanish bank account to handle the purchase of real estate, including payment of the purchase price to the seller in the form of checks at notary appointments. It is important to inquire about any fees that may be charged by Spanish financial institutions for these "bancarias" checks. Also, you will use your Spanish bank accounts later to pay for the furnishings of your property and other ongoing expenses.

- Lawyer: It is highly recommended that you hire a local independent lawyer early in the buying process to ensure that your interests are protected. A good lawyer will assist you in obtaining all necessary legal documents and help you ensure a safe real estate purchase. In addition, a lawyer will also check the legality of the land or property, as well as any debts that may be owed on the property.

The basic documentation that every property should have

In addition to the legal requirements, it is extremely important that the property you are interested in has a number of important documents that are necessary for the real estate purchase or loan application and also confirm the legality of the property. These documents are crucial to ensure the legitimacy of the property and to successfully complete all the necessary formalities, from the loan request to the real estate purchase or insurance of the property.

- An updated extract from the land register (Nota Simple). The Nota Simple is an official extract from the land register that contains a brief description of the property, its boundaries, details of the owner and any encumbrances or mortgages.

- Title Deed (Escritura): an essential document for the transfer of absolute legal ownership from the original owner of the property to the acquirer. The formal document indicates who owns the property and also contains a summary of the property.

- Energy Efficiency Certificate: The Energy Performance Certificate (Certificado de eficiencia energética) shows the energy efficiency of a property in Spain; this is represented by letters from A to G, where A is the best efficiency and G is the worst.

- Certificate of Habitability (Cédula de Habitabilidad): The cédula serves as proof that a property meets the minimum requirements for usable housing. These requirements include certain size specifications, technical equipment, and sanitary facilities. The exact definitions of these requirements are set forth in the respective building codes. It is important and required for connecting a building to utilities such as electricity, water, gas or telephone.

- Community Certificate (Certificado de Pgos de la Comunidad): It is necessary to present a certificate from the community of owners if you want to buy a property in Mallorca. This certificate confirms that the seller has always paid contributions to the community on time and is up to date on payments.

- Last receipts for payment of property tax, as well as garbage collection fee and a bank certificate for any outstanding debts.

- In the case of new buildings, the certificate of completion/acceptance of construction and the certificate of installation of water, electricity and gas.

It is best to have the property professionally inspected

Real estate experts know the pitfalls that can come with buying property in Mallorca. Before you decide on a property and sign a reservation or option contract, you must thoroughly inspect the property. The warm and humid climate of Mallorca places high demands on the condition of many properties. For this reason, you should check the house for moisture damage and the condition of the electrical and plumbing systems. As part of this analysis, you can also make sure what heating options are available and what condition the windows, doors and plumbing are in. In Arnd's article you can read more about some classic problems.

Is everything registered?

It is crucial to make sure that all the information in the purchase deed matches the reality. For example, if the house has a pool but it is not listed in the purchase deed, there is a possibility that the pool was built illegally. As a first check, you can check the plot and the built-up area in advance by looking at the exact address here in the cadastre. However, it is still important to read the purchase deed thoroughly, as it is more reliable than the cadastral extract and is, after all, the document that will be notarized.

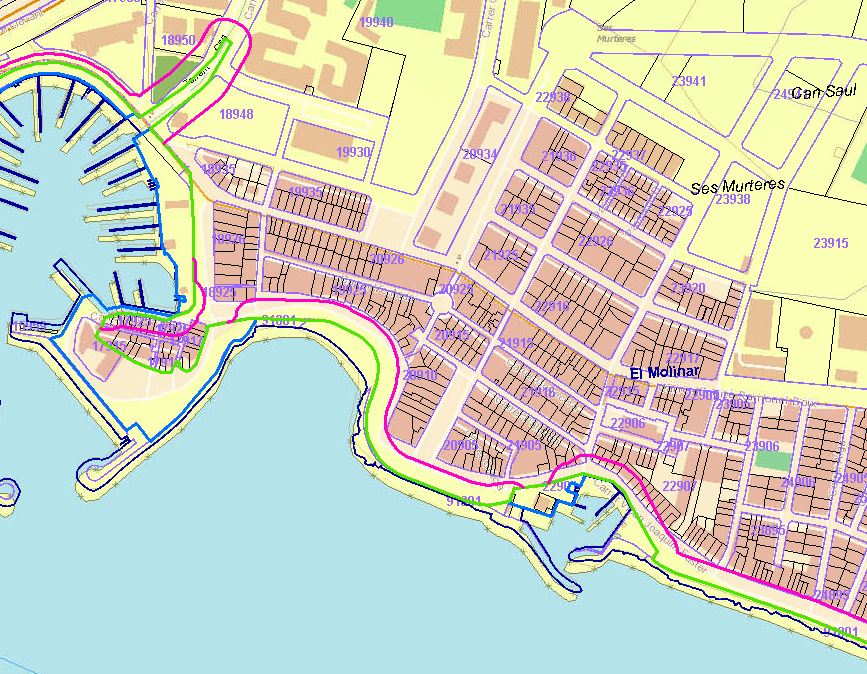

If the property is located on the coast, you can use this tool to check whether the coastline touches the property or not. Everything behind the green line belongs to the public zone.

Real estate purchase incidental costs

When buying a property, you should not only have the purchase price in mind, but also the additional costs that are associated with it. Usually, these costs range from 10% to 12% of the purchase price. It is important to find out about these costs in advance to make sure you have enough budget. Costs associated with buying a property in Mallorca include notary fees, land registry costs, VAT on new (IVA) when buying new, purchase tax (ITP) when buying used property and stamp duty (AJD).

It is important to consider these costs in advance to ensure you are not surprised by unexpected expenses.

Funding

If you want to buy a property abroad, important questions arise when it comes to financing, such as which banks can handle the financing. For real estate financing in Mallorca, you can choose a German bank, but most German banks do not offer mortgage loans for vacation properties abroad unless there is sufficient collateral in Germany. German banks that also operate in Spain will encumber the property locally according to Spanish law.

Financing through German banks has the advantage of German conditions, including a fixed interest rate for the corresponding term. However, real estate financing in Mallorca is too uncertain for many German banks, because a sound property valuation is often missing. If you choose a Spanish bank, you have the choice between a fixed rate mortgage or a variable rate mortgage, which can also be combined. With a fixed rate mortgage, the interest rate remains unchanged throughout the term, but the loan must be repaid in full during the financing period.

A variable rate mortgage is linked to Euribor and is reviewed and adjusted annually. The equity ratio for a real estate financing is usually up to 60%, and you need personal documents and proof of your net income and assets. The Spanish banks take the net income as a basis and require a statement with the current monthly charges. Furthermore, you will need photocopies of your passport or ID card, the N.I.E, the last three pay slips, the last income tax return and the last income tax assessment, as well as bank statements of the last 3 months and property-related documents.

Reservation and option contracts

Once the dream property has been found and the price negotiated, the first step is to sign a reservation or option contract. A reservation contract (Contrato de Reserva) makes sense if you have a real interest in buying the property, but the financing is still uncertain. The reservation contract has the character of a letter of intent. You pay a small deposit and the seller agrees to reserve the property for a period of time. If a purchase contract is concluded, the deposit is credited to the purchase price, if not, the money is lost.

The situation is different with an option contract, which is similar to a binding declaration of intent. In return for a down payment of 10 percent of the purchase price, the interested party acquires the right to purchase the property within a precisely defined period of time. If the contract is concluded, the option payment is credited against the purchase price. If no purchase contract is concluded for reasons for which the interested party is responsible, the entire down payment is lost. If the seller is responsible for the failure of the purchase, he must pay the option payment plus compensation to the buyer.

Tax aspects

If you are buying a property on Mallorca, you should inform yourself in advance about the various taxes and duties that may apply when buying, selling or renting.

Current annual taxes

As the owner of a property in Spain, current taxes are an important aspect to consider. Property tax, income tax and wealth tax are payable annually and can vary depending on the municipality, type of use and value of the property. It is therefore important to find out about the respective tax rates and allowances in order to avoid any unpleasant surprises. In this context, it also makes sense to seek advice from a tax advisor in order to take advantage of possible tax benefits and deductions.

- Property taxes: They are levied by municipalities on the basis of the cadastral value of rural and urban properties. The taxpayers are the owners, leaseholders and usufructuaries. The amount of land tax is set by the municipalities and ranges from 0.4% to 1.1% for developed land and from 0.3% to 0.9% for undeveloped land.

- Income taxes: If the property is owner-occupied, 19% tax is levied on 1.1% of the cadastral value as notional rental income. If the property is rented out, 19 % tax must be paid on the rental income, whereby various costs are deductible, e.g. interest on mortgage loans, community costs in the case of a residential complex, property tax, maintenance costs, insurance, costs for utilities, depreciation = 3 % p.a. on the value of the building.

- Wealth Tax: The tax rate for non-residents ranges from 0.2% to 3.5% for all property located in Spain. In the case of a property, the highest value is taken from the cadastral value, the acquisition value or the value established by the tax authority. There is an allowance of €700,000 that each owner is entitled to if the property has multiple owners.

I hope we could give you some useful tips with this guide.

If you are still missing something, feel free to contact us and we will add to our guide.